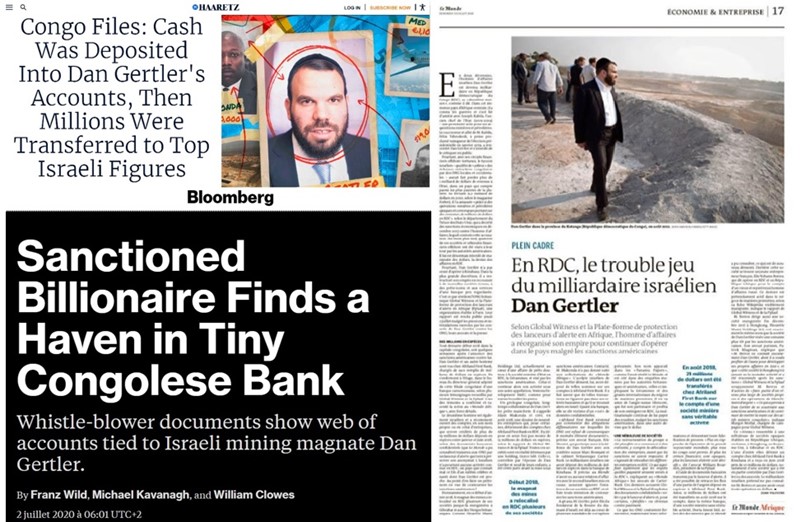

On July 2nd, 2020, a joint investigation by PPLAAF and Global Witness, “Undermining sanctions”, uncovered evidence indicating controversial mining magnate Dan Gertler allegedly used an international money laundering network to attempt to evade US sanctions and continue doing business in the Democratic Republic of Congo (DRC). This scheme seems to have allowed him to funnel millions of dollars abroad and acquire new mining assets in DRC. PPLAAF worked on this investigation for more than a year with Le Monde, Bloomberg and Haaretz in Israel.

The groundbreaking evidence has shown the workings of Gertler’s complex business empire and a system designed to conceal the movement of millions of dollars. This scheme would allow Gertler to continue reaping the vast financial benefits of his business deals in DRC, despite being sanctioned by the US Treasury Department in December 2017 for “opaque and corrupt mining and oil deals”.

The sanctions against Gertler, a close friend of DRC’s long-time former President Joseph Kabila, prohibited him from doing business with US citizens, companies, or banks. PPLAAF and Global Witness have revealed evidence indicating that despite this, Gertler may have found a way to continue to handle US dollars, consolidate his fortune and even acquire new assets in DRC. The revelations highlight critical loopholes and lapses in international sanctions enforcement and anti-money laundering frameworks, with lax banking regulations, lawyers and corporate secrecy enabling the scheme.

The report also showed how two major international mining companies operating in DRC, Sicomines and ERG, appear to have made payments to customs and logistics agencies controlled by Gertler or his associates while Gertler was already under US sanctions. The multinational commodities giant Glencore, which has ties to Gertler stretching back to 2007, has been also continuing to make highly controversial royalties payments to him, despite US sanctions. The report’s findings suggest that Gertler relocated his business interests from secretive offshore tax havens to DRC with the help of proxies. Gertler and his network of proxies then set up bank accounts at the Congolese branches of Cameroon-based Afriland First Bank. New names started to appear on both companies and bank accounts connected to Gertler in a variety of subtle ways, including the name of someone implicated in a VAT carbon tax fraud costing the EU €5 billion.

In total, between June 2018 and May 2019, at least $100 million flowed through bank accounts associated with this network. Much of it was denominated in US dollars, despite the US sanctions, and almost 70 percent of it was deposited in cash into accounts apparently connected to Gertler or his associates.

Among the various transactions revealed, at least $21 million was sent to unknown accounts held outside DRC and $25 million was sent to DRC’s controversial state-owned mining company Gécamines. Gertler seemingly used proxies to make these payments to Gécamines in exchange for new mining licenses, just before the 2018 elections. This is reminiscent of deals Gertler did with the state miner before the 2011 elections – a scheme that contributed to the imposition of sanctions for “corruption”.

A month after our report, US NGO The Sentry revealed that North Korean businessmen also used Afriland DRC to bust UN, EU and US sanctions imposed against North Korean businessmen.

In February 2021, a second series of revelations related to Dan Gertler was unveiled. Gradi Koko and Navy Malela, the two whistleblowers behind the revelations that led to the publication of the report, revealed their identities to the public. Respectively former head of the unit’s internal audit division and comptroller in charge of the audit department and computer scientist at Afriland’s Congolese branch, the two men shared with PPLAAF and the investigative consortium thousands of bank documents from late 2017 to early 2019.

The disclosure of the whistleblowers’ identities was followed by articles published in various media outlets such as RFI, Bloomberg, Africa Confidential, Haaretz and Mail and Guardian further demonstrating that Afriland First Bank CD had allowed people close to Dan Gertler to convert millions of dollars into euros in cash. A Dan Gertler affiliated company, Western Financial Services, created after he was placed under sanction, received a quarter of the total loans from Afriland’s Congolese branch in early 2019. Despite PwC’s acknowledgement of strong links between Gertler and this company, its report on Afriland First Bank CD’s 2018 financial statements stated that the bank’s accounts complied with DRC accounting principles.

In the backstage of PPLAAF’s disclosure, there are also threats, intimidations, and blackmails against the NGOs and the press. Prior to the publication of the report, Gertler’s lawyers sent us a series of letters over more than 2 months that included wild accusations against both Global Witness and PPLAAF and threats of legal action. The day before the publication of the first revelations, dozens of conspiracy videos flourished on Congolese social networks against both organizations. The report “Undermining sanctions” was followed with a criminal complaint against both organizations and a libel suit in Israel against Haaretz. Both organizations obviously criticized the tactic as a SLAPP procedure.

Gradi Koko and Navy Malela were sentenced to death and have since forced to remain in exile. On February 25, 2021, the day before the latest revelations were published, Afriland’s lawyers held a press conference in Kinshasa where they revealed that the two whistleblowers had been sentenced to death by a Kinshasa court in September 2020, in addition to having been sentenced to prison terms on no less than eight different charges. This sentence was denounced by the UN, diplomatic missions in DRC, and many civil society organizations, as described in Le Monde, Médiapart and RFI. Since then, PPLAAF has been actively working to have this conviction revoked.

PPLAAF and its chairman have been subjected to other direct threats openly intended to inhibit publication. Journalists were under threat too: an Haaretz journalist working on the investigation reported Gertler threatened to “finish his career”.

It was to fight corruption in the DRC that the U.S. sanctions had been imposed upon Dan Gertler in 2017 and 2018. However, on January 15, 2021, the Trump administration quietly granted a license allowing Gertler and his companies access to the U.S. financial system until January 31, 2022. The U.S. government’s last-minute measure effectively lifting sanctions imposed on Israeli billionaire Dan Gertler for a year and immediately drew criticism from members of the U.S. Congress and 30 Congolese and international NGOs. Finally, after taking office, President Joe Biden reinstated US economic sanctions against the Israeli billionaire.

Following the revelations, PPLAAF led a campaign in the DRC alongside the «Congo is Not for Sale» coalition to fight for concrete measures to be adopted. The campaign included a social media campaign and a call to reform the banking sector. PPLAAF-supported whistleblower Jean-Jacques Lumumba was one of the campaign’s major spokespersons during this period.

The disclosure was largely covered in international media, and members of PPLAAF interviewed on TV5MONDE, RFI and Deutsche Welle. PPLAAF West Africa coordinator Fadel Barro intervened to explain how such corrupt practices expose African economies to grave danger.

In September 2020, Nobel Prize winner Denis Mukwege and Congo is Not for Sale spokesperson Jean-Claude Mputu attended the European Parliament commission on human rights and demanded to stop impunity and protect whistleblowers in the Congo. Several EU MPS regretted that perpetrators of corruption could continue their business activities within the European Union